How much money should I have saved by 30?

If you are under 35, you already have the biggest advantage for your future retirement. Yes, you may have debt, mortgages, and Netflix subscriptions that sink your wallet but if you can invest anything right now, you will significantly benefit your future.

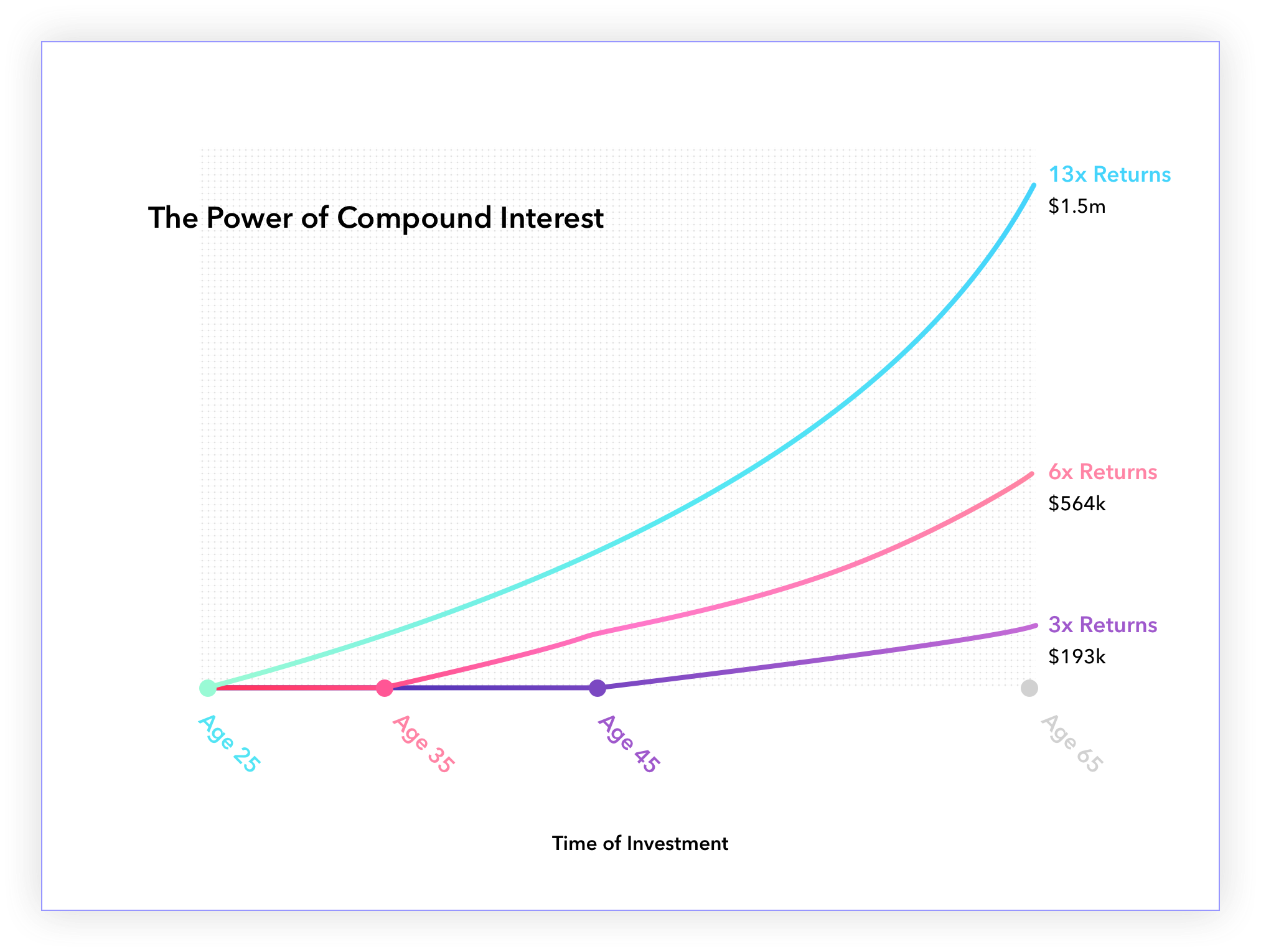

How much you invest per month is important but nothing compared to what time can do to your money over 35 years. Imagine a machine that every $1 you put in, you get $6 out. That’s what compound interest does with time. The upsides of getting 6x return on your investment could mean early retirement, earlier financial independence, and a badass lifestyle for your older self.

Starting with the “rules of thumb”

It’s a common desire to want to know how you are doing compared to others your age. But investing is far too individualized to make decisions based on how you stack up. These “Magic” Savings Figures often do more harm than good. Sometimes comparing can discourage you and leave you not taking any action.

It’s best to research all the ways you can create healthy behaviors with your money. If you haven’t started investing, think about how you can start, even if that means putting away $30 a month. What actually matters the most now is how early you start, not how much you can invest each month.

Having said that, let’s take a look at some common short-hand saving rules for determining how much you should have saved by age 30.

The 1x salary rule

According to Fidelity Investments, you should have at least 1x of your annual salary in savings by age 30. This 1x Rule is part of Fidelity’s Savings Factor, which shows age-based savings benchmarks to help you determine if you’re on the right track.

- Age 30 - 1x your salary

- Age 35 - 2x your salary

- Age 40 - 3x your salary

- Age 45 - 4x your salary

- Age 50 - 6x your salary

- Age 55 - 7x your salary

- Age 60 - 8x your salary

- Age 67 - 10x your salary

So if you are 30 years old making $80,000 / year, you should have $80,000 saved. Some financial experts argue that this 1x figure is really your entire net-worth: cash savings, retirement account contributions, real estate, and other types of investments subtracted from any debt that you have (school debt, credit card debt). Your net-worth is the total savings and assets minus your total debt.

If your debt is bigger than your assets, it’s not the end of the world. Having a negative net-worth at age 30 is common for many 30 year olds that are paying a large college tuition every month. In fact, as Jane Brockway of CRPC puts it, some 30-year-olds are more likely to have a year’s salary in debt than in savings.

The hard reality shows us that 1 in 5 people have no retirement savings in place at all and About 66% of Millennials between the ages of 21 and 32 have absolutely nothing saved for retirement, according to the National Institute on Retirement Security. So 2 out of 3 of your friends haven’t even started retirement savings, let alone a retirement savings equal to their salary.

So how practical is it to follow the 1x rule?

Using this rule for retirement planning can be helpful in determining an end goal. For example, you need 10x your salary for when you hit 67 years old. To figure out your total retirement number, just add another “0” to the end of your salary: eg $100,000 Salary = $1,000,000 Retirement Savings.

Keep in mind that you are not actually saving 1 million dollars throughout your life. It’s not just savings that you put away that creates the $1 million savings pot. That total retirement number includes what compound interest does to your money (making interest on your interest).

- Starting Age: 35, Retirement age: 67

- Average monthly investment savings: $396 per month

- Total retirement invested (money you put in): $166,666

- Total retirement savings (money made on interest): $1,000,000

Super important side note: Investing your money can be used for other things as well, not just retirement: a college education for your kids, a new home, or a business that you want to start. The advantage of starting soon is that you have more time for compound interest to build. Starting early means financial independence is sooner. Perhaps you can never see yourself retiring. You want to work, it brings you purpose and fulfillment. Retirement shouldn’t be synonymous with not working. Financial independence means you don’t rely on work to survive. You can choose to travel and you can choose what type of work you want to do. You have the choice, money doesn’t.

Making your retirement personal

If you are finding yourself behind the “1x salary by age 30,” take heart because what really matters is that you are investing early. Longevity of time is far greater than the amount at this point in your life. Hard time believing? Try out the investment calculator and change the start date to see the numbers grow. Start putting away money for retirement at age 30 and you could get 6x on your returns.

There are so many things in life that can set you back from putting money in retirement. Real life can throw curve balls that derail you from saving for retirement. And then you’ll wonder, “How on earth am I going to even think about saving money when I can barely make my student loan payments?” Should you focus on retirement or repayment?

Guess what—you’re not alone with these thoughts. According to a GOBankingRates survey, about 57% of Americans struggle to save money, with less than $1,000 saved up. And then they hear about the 1x Rule, the 3-6-9 Rule, the 4% Rule, and are thinking retirement investment is never going to happen and they’ll never save up as much. They eventually throw their hands up and give up prematurely.

And this is exactly why being smart about your savings and starting early can mean the difference between your ideal retirement and being a workhorse for the rest of your life. It really doesn’t matter how much or how little you set aside at first, as long as you start early.

So, when it comes to retirement, don’t let all the rules and seemingly impossible success stories get the better of you. The thing is, when it comes to your own personal retirement and unique financial situation, there really is no one-size-fits-all situation.

One of the best things to do to figure out just how much you need to retire at the age you want with the money you’re earning is by using a retirement calculator. It can help get rid of the guesswork. It can also show how much you need to set aside over the years based on several factors, such as your current situation, how much you’re earning, what you want to do when you retire, and when you plan to do it. We’ve also created a tool to help you determine how much you need to retire.

Money savings tips for 30-year-olds

So, if you think you’re not yet on track with your own retirement savings, there are things that you can do to catch up. Here are 10 quick tips to help you save more:

- Save those pennies. This is pretty basic—but it works. Don’t underestimate the piggy bank and start filling it up with loose change. Even a pickle jar is enough to get you started. Once it’s full, you can start a savings account and deposit your coins there. You can even grow your spare change by investing them through Acorns.

- Track your money. Know exactly how much money is coming in and going out, and what your spending habits are. You can use expense management apps such as Expense Manager, Dollarbird, Fudget, and Wallaby. Tracking your money can help you get a better handle on your spending and see where you can cut back and be Frugal Freddy.

- Create a budget and stick to it. Create a budget. From your utility bills to your groceries down to your entertainment and leisure expenses, you must set just how much you should spend and how much goes to savings—and follow these to a T even when no one’s looking.

- Buy in bulk. You can save time, gas and fare with fewer trips to the supermarket. Besides, buying things in bulk is a lot cheaper. The key here is to create a list for monthly grocery shopping, avoid unnecessary stuff, and stick to the program.

- Ditch dining out. Imagine how much money you’re spending monthly when you eat out. Now think about how much you could have saved in a year if you eat dinner at home. Even the simple act of ditching your daily Starbucks run and bringing your own coffee from home can give you significant savings—and when you throw in compounding interest, that can greatly help your retirement nest egg.

- Live within your means. Come back to Earth and stop dreaming about that designer bag that’s worth your month’s salary, that cruise you can’t afford, or that gadget that’s sure to blow your budget. Stop relying on credit cards, or better yet—pay them off and cut them up for good.

- Find multiple streams of income. With stagnant wages from your 9-to-5 and the rising inflation, it’s difficult to make enough money when you can barely make ends meet. So don’t rely on just one source of income. These days, technology makes it easy for you to find gigs that can suit your location, lifestyle, and schedule. You can also sell stuff you don’t need online, rent out a spare room, or even start your own blog.

- Make your money work for you. Invest in your employer’s 401(k) plan. You can also look into alternate retirement savings account, or try out online investment platforms and money apps such as Robinhood, Tip Yourself, and Acorns.

- Automatically take out retirement investment from your pay check. Live your budget as if retirement investment was a necessity, like your rent or groceries.

- Start by saving your age. If you are 25, try saving $25 a month. The hardest part is to start so start small and work your way up.

Final thoughts

Your 30s are the perfect time to start retirement saving. You are already at an advantage by being young and thinking about money. However, going from 0 to 1 is still the hardest part so if you started, you’re already doing better than most people your age.

The key takeaway is this: don’t spend your time reading about how well you are doing compared to others. Instead, spend your time thinking about creative ways to save more money. Maybe that means asking for a raise every year. Maybe it means driving less or selling your car entirely! Even renting an extra room on airbnb can make you an extra $11,088 a year! There are plenty of ways to save and the best part is that you are in your 30s so start today.