Get started making money using Airbnb

Let’s talk about making money. If you are thinking about early retirement or bulking up your total retirement savings, you’ve got to consider the variety of unconventional ways out there for you to make some extra cash on the side. Unless you make a dangerously high income where an extra ~$11,000 per year won’t help, you could benefit from low effort income sources. So here is the big surprise: Airbnb hosts make an average of $924 per month, that’s $11,088 per year in extra income. If you own a home or lease some kind of dwelling, you can turn your unused space into a money making machine! Make money in your sleep, literally. Using your extra room or even a couch, you could be sitting, or sleeping, on a money machine (pun intended). It’s never been easier to make money being a part of the Gig Economy.

Capitalizing on the gig economy

This age of collaborative consumption and the gig economy opens a new horizon for people to earn income using methods that traditional economy wouldn’t have allowed. According to Bankrate, 44 million Americans have a side gig, and 25% of the millennials in the survey earn $500 or more each month. While this may not pay the rent, it can give you an early head start into bulking up your retirement fund.

And with Airbnb opening accommodations in homes and other unorthodox locations in 34,000 cities all over the world, you can also jump on the bandwagon to start making side income to invest for retirement.

Airbnb is one of the most creative ways to make big money and then save that extra income for retirement. It is a platform that allows you to rent your room or property as a temporary accommodation to travelers. Perhaps you have an extra room or two in your house that you can turn into a rental property instead of gathering dust. And with Airbnb hosts earning an average of $924 monthly, it’s not such a bad idea.

Remember, time is your ally

On top of your salary, having extra income from Airbnb can help bolster your retirement savings, especially when you start early, like right now. This is because the secret to your ideal retirement life lies in being the early bird.

For most people, achieving their ideal retirement savings by the time they want to retire is not easy. Unexpected expenses and other things can happen along the way, which can set you back. Therefore, having another source of income is important, and you can take advantage of technology and how easy it is to have a lucrative side gig, thanks to Airbnb.

As an online marketplace that connects travelers with people looking to rent their homes, Airbnb has come a long way since it was established in 2008. From being a community for budget-conscious tourists to business travelers in search for unique experiences on the road, it’s now a multi-billion-dollar industry. On any given night, 2.5 million guests are staying in homes, and over 4 million Airbnb listings worldwide.

The market for guests wanting to stay your home is there, and if you have an extra room to spare, you can rent it out by listing your property on their platform. What’s great about this is it doesn’t cost a thing for you to list your property, whether it’s a room, a floor, a couch, a house, a yacht, or even a castle.

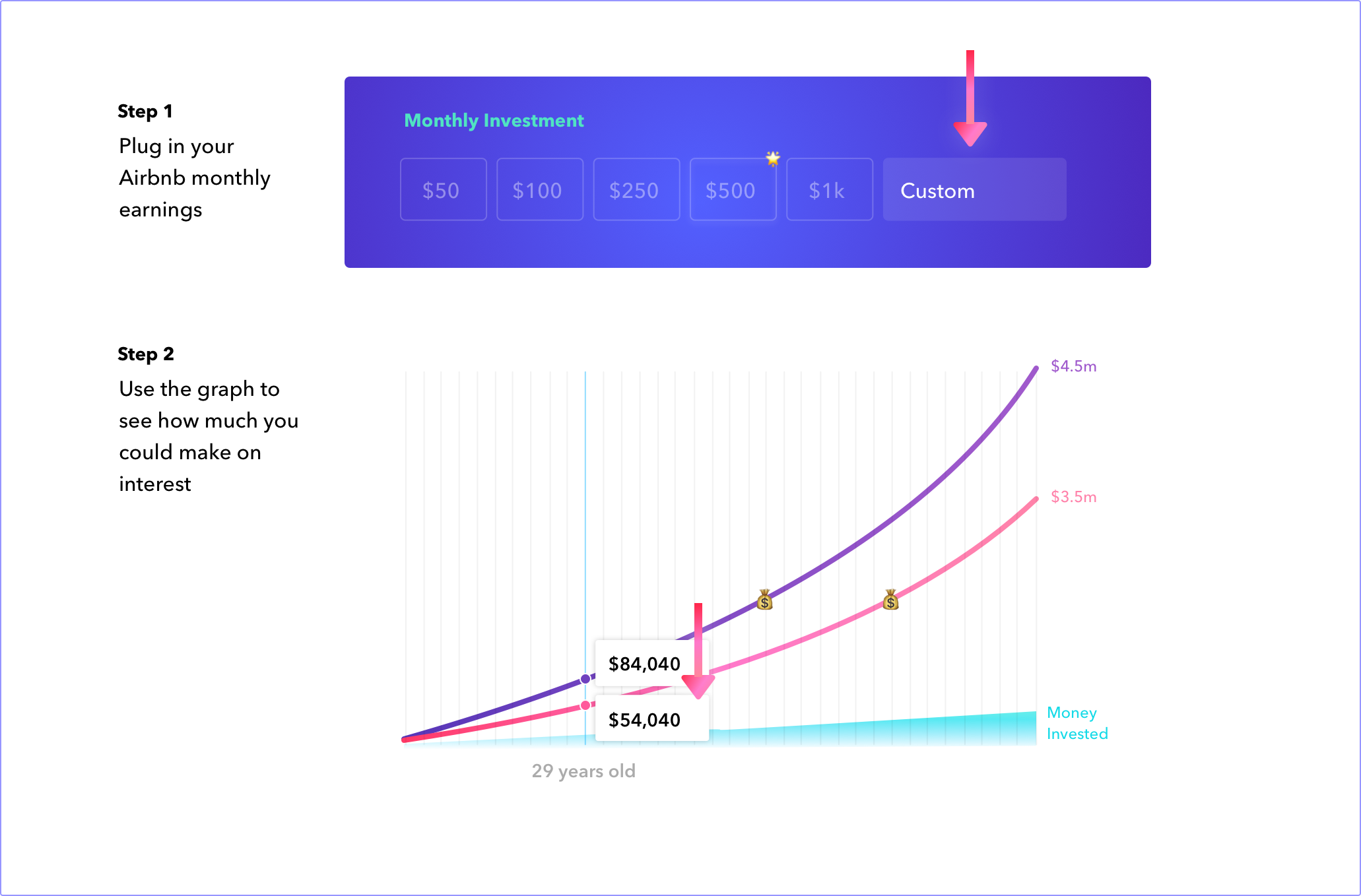

You make money by setting your own accommodation rates. According to SmartAsset, Hosts are making up to 81% of their mortgage. That is a substantial amount of money that can go a long way once invested into your retirement fund. Using our investment calculator, you can quickly figure out how much you can expect to get once you start becoming an Airbnb host.

Make sure to notice the power of compounding interest that would take your side income and increase your fund exponentially over time, allowing your money to make money. It’s a beautiful thing.

How does Airbnb work?

If the strategy of using Airbnb to earn and save money for your retirement fund is appealing to you, it’s still important to remember that it’s not just about collecting rents. You must also consider the costs of having a rental property: cleaning, upkeep, and upgrades, to name a few. To be more specific, while Airbnb doesn’t charge for listing and you’re free to set your rates, the platform will charge you a 3% service fee for every reservation. You have an option to add a cleaning fee on top of this, which is in addition to your daily rate. On the other hand, guests would expect to pay a security deposit which is set by you, the host. Airbnb also charges guests a booking fee ranging from 0% to 20%. Once a guest reserves your listing, Airbnb charges them through a secure payment system so you don’t have to deal with the guest’s money directly. Airbnb automatically sends the payment to your account within 24 hours after your guest checks in, deducting the 3% fee. You can set up to receive payments via PayPal, direct deposit, and many other methods. Meanwhile, to protect property owners against accidental damage, the platform covers hosts up to a million dollars. Hosts also get Host Protection Insurance, which protects them when guests get hurt or cause property damage and covers up to a million dollars of liability claims. Both guests and hosts must submit valid identification and strict verification measures. Hosts also have the liberty to approve guests. All these measures are in place to protect the safety and security of hosts and guests alike.

Make the most out of Airbnb

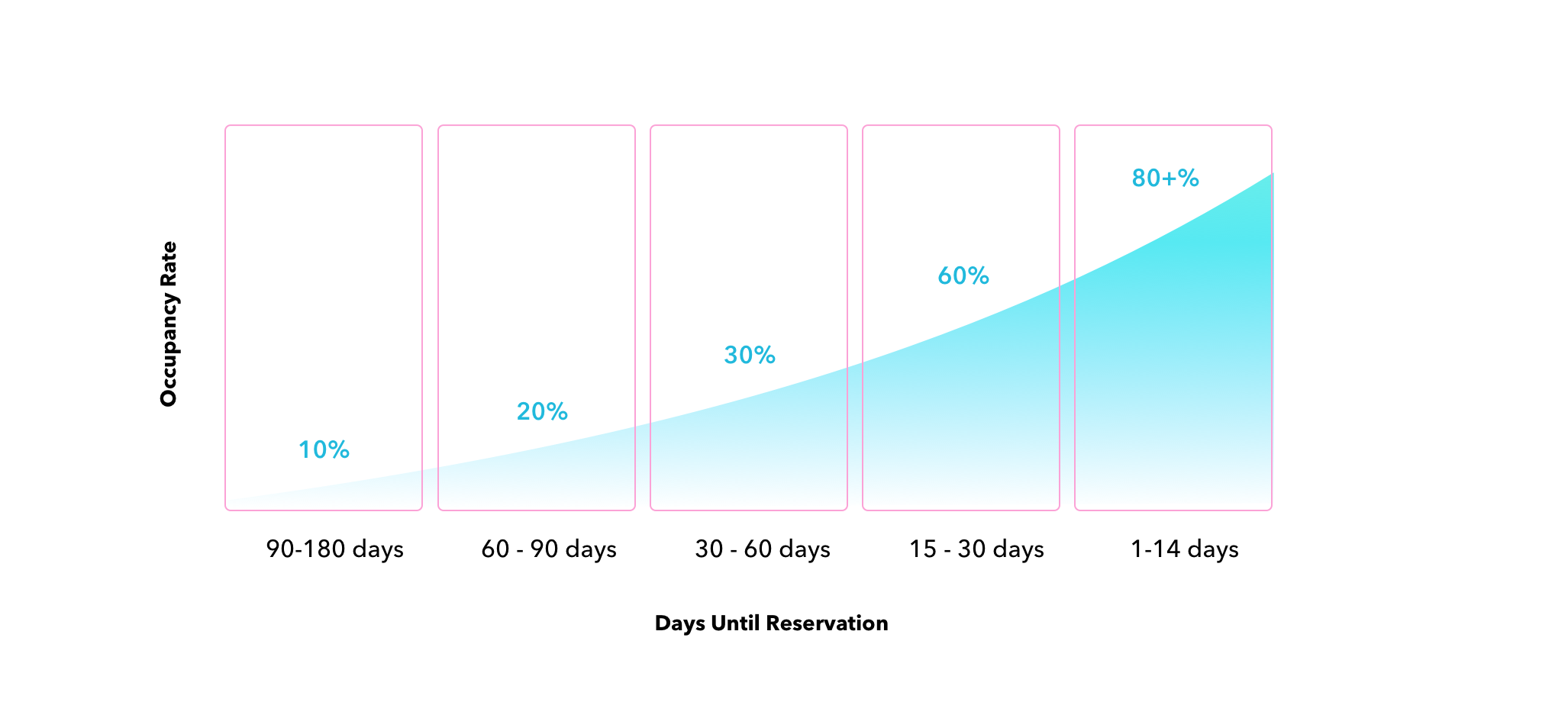

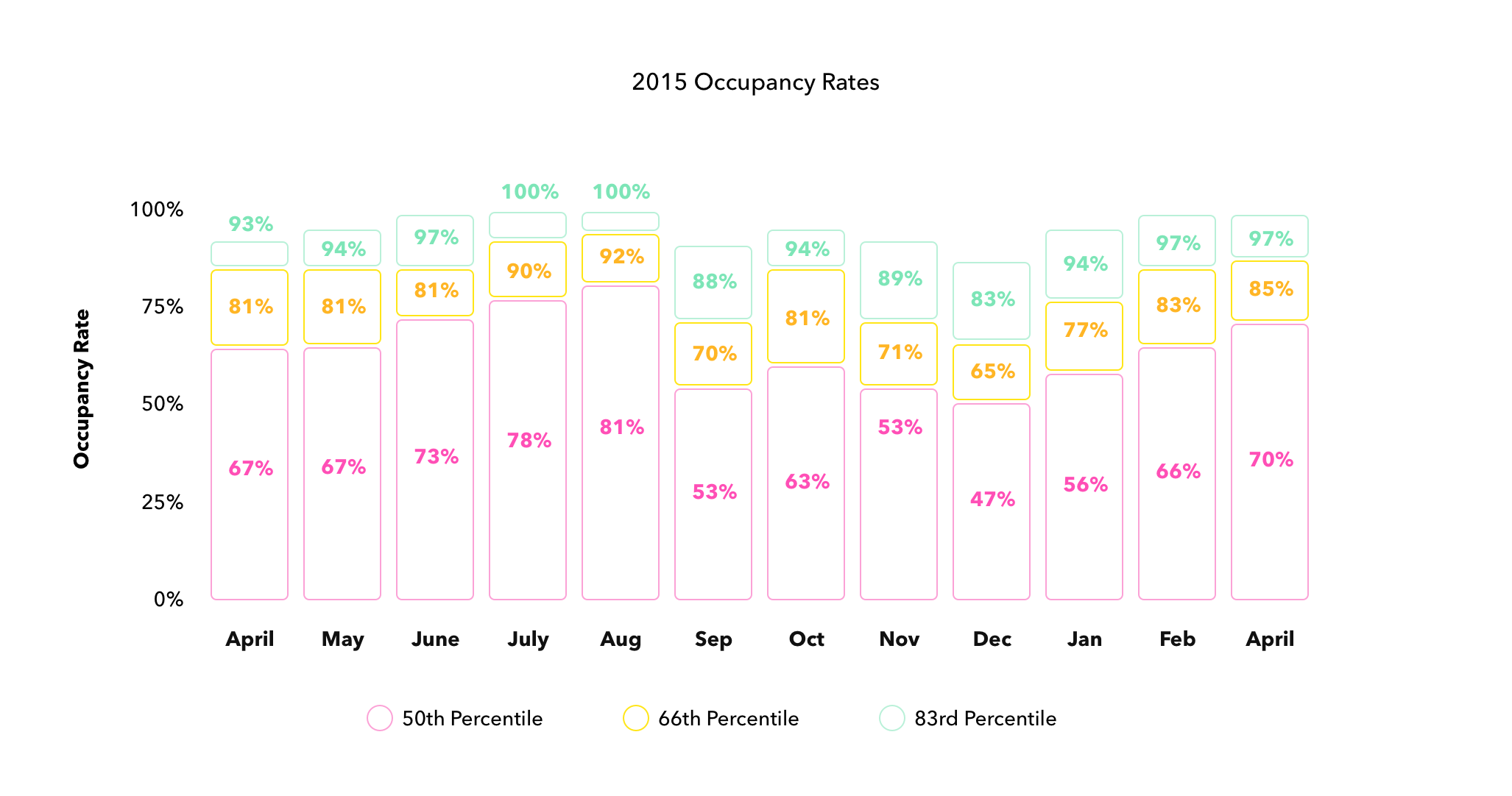

Once you get the hang of it, you’ll find that earning money for retirement through Airbnb isn’t so hard at all—and you can make money fast. If that doesn’t whet your appetite, consider these 75 people who earn $1M a year from the platform as inspiration. To help get you on the right track, there are several tips and tricks from the growing Airbnb community to help you make the most of your property, increase your occupancy, and keep earning for retirement. For example, one of the first things Airbnb hosts need to learn is how to set their pricing to stay competitive in the market. Here, you must compare your listing to similar ones within your area. You must also consider your weekday and weekend pricing schemes. The site Beyond Pricing helps you figure out how much you’ll make based on where you live, the season, and the day of the week. As for occupancy rates, you can maximize this with a highly recommended strategy - if you have more than 25% of your nights booked for the next 3 months, then you can increase your price strategically. Then, as your availability increases, dramatically reduce your price each week. As you get used to this, you’ll get a better grasp of the demand at each price point you set.

To explain this a bit further, if you have vacancies in less than one week, you can drop your rates at a bargain price to attract more bookings. Remember, for a business such as Airbnb, your goal here is to have as many bookings as possible. You’ll realize that when it comes to saving for retirement, any little amount you earn now is a good investment. Of course, let’s also not forget the basics. It helps to describe your place accurately and create an eye-catching, stand-out listing. Make sure that your listing is detailed and complete, outlining the amenities and features while highlighting what makes your property unique. Invest in high-quality photos of your property. If you can’t do this by yourself, hire a photographer. In some areas, Airbnb even offers professional photography services to give you a hand. To keep your place looking clean and updated, you must include regular cleaning and maintenance. Hire a professional to do this for you and include the expenses to your pricing scheme. You may also want to update your space to make your guests feel more comfortable or to even increase the value of your property. And at the end of the day, whether you’re going for quaint and rustic, or modern and high-tech, it’s all up to how you make your guests feel during their stay. Your success in this endeavor lies in a vital element: customer service. Your Airbnb business is a hospitality business, so make customer service top priority. Be responsive to customer inquiries and act promptly on the reviews. Whether the guest feedback is positive or negative, you must be gracious and see this as a way to improve. If there are problems, fix it as soon as you can to increase your guest ranking and therefore increase your visibility in the marketplace.

Final words

The rise of platforms such as Uber, DogVacay, Snapgoods, and TaskRabbit shows how people embrace the sharing economy. And with Airbnb at the helm of this growing industry, you have a great opportunity to earn and save money in ways that you couldn’t have done just several years ago. By starting now, you set for yourself a solid foundation from which to build your dream retirement lifestyle in the future. Hopefully, nearer than you think :) Lastly, if you need help with starting off on Airbnb, making more money, dealing with negative ratings, or even trusting strangers, there are many great services such as Learn Airbnb or Renting Your Place that can guide you throughout your side income business. Now go make that money!